Anglais

‘I was beginning to lose hope’: Woman battles bank for 2 years for information on her own account

Published

5 années agoon

By

admin

[ad_1]

An Edmonton woman who spent two years battling her bank for information about her own account is defying a confidentiality agreement to go public about what happened, in a bid to shed light on a highly secretive system she says is stacked against the customer.

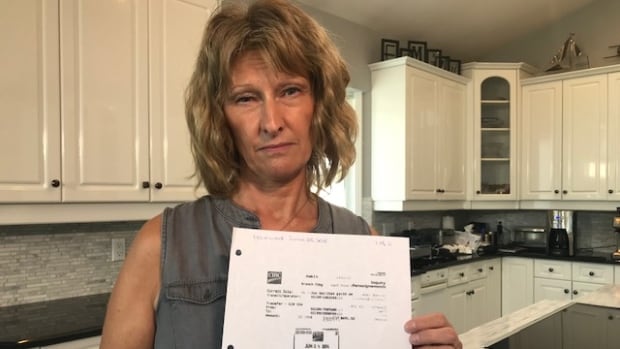

« Numerous phone calls, numerous emails. I documented everything, » Rhonda McMillan told Go Public during an interview at her home where she showed us boxes of paperwork — the result of her long fight with CIBC for a document she believed would confirm unauthorized activity on her account.

In 2016, McMillan noticed $691 had been moved from an account belonging to her and her husband to an account she had with her son which was closed a month earlier.

McMillan says the bank slip she fought two years to get appears to show that a CIBC manager and another employee signed their own names authorizing the transfer of the money, reopening the account without her knowledge or permission.

« It wasn’t our signatures and it shook us, » says McMillan.

She has no idea why the bank would do that, and may never know. After waiting months and months to get the document she wanted, she says the bank told her too much time had passed to get answers.

Two years after money was transferred from her account, Rhonda McMillan still doesn’t know why the transaction occurred without her authorization. These are just some of the documents she has chronicling her fight with CIBC. (Trevor Wilson/CBC)

But it’s not only the unauthorized transaction itself that concerns McMillan — it’s how hard she had to fight to get basic information about activity on her own account and get answers to what happened and why.

« I was beginning to lose hope. I’m pretty persistent, but I was getting worn down, » she says.

Secretive complaint system

The banking complaints system is surrounded by secrecy and dominated by the banks, says Wanda Morris, a consumer advocate with CARP.

« We’re at a crisis, » says Morris, who would like to see a major overhaul of the system.

In order to get the document she was looking for, McMillan initially filed a complaint with CIBC’s ombudsman.

The bank and its ombuds service told her she had to sign a confidentiality agreement, promising not to tell anyone what the document revealed, and not to disclose anything about the investigation or any settlement to anyone.

If they want to come after me … then bring it on.– Rhonda McMillan

McMillan says she reluctantly agreed to sign the gag order, but contacted Go Public anyway, after receiving a copy of the bank slip for the transaction she says was carried out without her knowledge.

« If they want to come after me … then bring it on, » McMillan told Go Public in an email.

Both the bank’s internal ombudsman and the national independent ombuds service, OBSI, required Rhonda McMillan to sign confidentiality agreements. (Trevor Wilson/CBC)

Go Public asked CIBC specific questions about the case, but the bank didn’t offer an explanation. In a statement, a spokesperson wrote that CIBC « strongly disputes the nature of the allegations. »

« As the matter is going through a dispute resolution process, we are unable to comment further, » CIBC spokesperson Tom Wallis wrote.

‘No wrongdoing,’ but settlement offered

McMillan didn’t lose any money but the bank did offer a financial settlement.

« They just would say there’s no wrongdoing — we’re not admitting to any wrongdoing, but here’s our settlement, » McMillan said.

Unhappy with the results of the investigation by the bank’s ombudsman, McMillan escalated her case to the national independent Ombudsman for Banking Services and Investments (OBSI), and was again asked to sign another non-disclosure agreement.

That investigation resulted in another settlement offer, but again, no explanation for why the money transfer was carried out without her knowledge.

Lack of transparency

Canada’s banking complaints system needs to be more transparent, says Morris.

Consumer advocate Wanda Morris of CARP says the current complaints system for banks is tilted in favour of financial institutions. (Rosa Marchitelli/CBC)

She says the system allows banks to chose which dispute resolution service will handle their customer complaints.

OBSI is a non-profit, independent consumer dispute service started by the federal government in 1996. It now only investigates two of Canada’s big banks — BMO and CIBC.

The three other big banks — Scotiabank, RBC and TD — jumped ship from OBSI and moved to ADR Chambers Banking Ombuds Office, a private company.

« We have a situation where essentially banks get to choose their referee, » says Morris. « And they’re consistently choosing the referee that investigates fewer complaints, that finds fewer of those complaints in favour of customers, and has less transparency about their findings. »

Neither OBSI nor ADR Chambers publicly releases the results of their investigations, the names of the banks involved or the amount of compensation handed out.

Sarah Bradley is the Ombudsman at OBSI, one of two external dispute resolution services used by banks in Canada. Banks are allowed to decide which service they use. (Gary Morton/CBC)

All banking consumer dispute services require non-disclosure agreements. Sarah Bradley, ombudsman at OBSI, says without the agreements, banks would be more cautious about taking part in investigations.

She wants to see one, non-profit, public service dispute resolution service that handles all banking complaints and is mandatory for all banks.

« The government of Canada should look at this issue very carefully. And it’s our view that the best interests of Canadian consumers would be served by having one ombudsman, » Bradley says.

Proposed legislation

Last week, the federal government introduced Bill C-86 (the Budget Implementation Act 2), which it says will improve consumer protection and make the banking complaints process more transparent.

If passed, it would:

- Require banks to keep a record of all complaints and make the information available to the commissioner of the Financial Consumer Agency of Canada (but not public).

- Publicly identify banks that commit serious breaches of their legal obligations.

- Prohibit banks from using misleading terms regarding their complaints-handling procedures, including terms that suggest independence. That includes the use of the term ombudsman.

- National dispute resolution services (OBSI and ADR Chambers) would have to publish on their website a summary of their final recommendations and the reasons for them.

The proposed legislation doesn’t include a plan for one independent dispute resolution service.

« We expect all approved external complaint bodies to maintain a strong reputation for being operated in a manner consistent with the standards of good character and integrity, and to ensure that complaints are addressed in an impartial and independent manner, » Pierre-Olivier Herbert, press secretary for Bill Morneau, wrote in an email to Go Public.

Moved money to credit union

McMillan says the OBSI investigation is now over and she’s waiting to receive a financial settlement from the bank.

She’s now moved all of her family’s money out of CIBC to a credit union. She started the process while trying to get the bank to hand over her account record — transferring money out little by little — while CIBC played what she calls « the procrastination game » with the document she wanted.

With files from Ana Komnenic

Submit your story ideas

Go Public is an investigative news segment on CBC-TV, radio and the web.

We tell your stories and hold the powers that be accountable.

We want to hear from people across the country with stories you want to make public.

Submit your story ideas at Go Public.

Follow @CBCGoPublic on Twitter.

[ad_2]

Source link

You may like

-

Mount Cashel: After 30 years, the pain still has not gone away

-

‘I feel like I’ve been deserted:’ B.C. woman trapped in Haiti says Canada not doing enough to help – BC

-

Renowned journalist Marie Colvin’s bravery well documented but none hold a candle to the woman she was

-

Residents of condo tower where woman threw chair off balcony say short-term rentals are not a problem

-

Was the Eaton Centre gunman in a ‘dissociative state’? Nearly seven years and two trials later, a jury is set to decide

-

A photo taken on Toronto’s Corso Italia 49 years ago became a family legend. No one saw it — until now

Anglais

Nostalgia and much more with Starburst XXXtreme

Published

3 années agoon

août 10, 2021By

admin

Get a taste of adventure with Starburst XXXtreme based on the legendary NetEnt Game. The nostalgic themes are sure to capture fans of the classic version as they get treated to higher intensity, better visuals, and features. The most significant element of the game is its volatility. Patience will not be an essential virtue considering the insane gameplay, and there is a lot of win potential involved. It retains the original makeup of the previous game while adding a healthy dose of adrenaline.

Starburst Visuals and Symbols

The game is definitely more conspicuous than before. The setting happens over a 5-reel, 3-row game grid with nine fixed win lines, which function if a succession from the left to the right reel is present. Only those players that that attain the highest win per bet line are paid. From a visual standpoint, the Starburst XXXtreme slots illustrates lightning effects behind the reels, which is not surprising as it is inherited from the original version. Available themes include Classic, Jewels, and Space. The game is also available in both desktop and mobile versions, which is advantageous for players considering the global pandemic. According to Techguide, American gamers are increasingly having more engaging gaming experiences to socialize to fill the gap of in-person interaction. Starburst XXXtreme allows them to fill the social void at a time when there is so much time to be had indoors.

Starburst XXXTreme Features

Players get to alternate on three features which are Starburst Wilds, XXXtreme Spins, and Random Wilds. The first appears on reels 2,3, or 4. When these land, they expand to cover all positions while also calculating the wins. They are also locked for a respin. If a new one hits, it also becomes locked while awarding another respin. Starburst XXXtreme offers a choice between two scenarios for a higher stake. In one scenario with a ten times stake, the Starburst Wild is set on random on reels 2,3, or 4, and a multiplier starts the respin. The second scenario, which has a 95 times stake, starts with two guaranteed starburst wilds on reels 2,3, or 4. it also plays out using respin game sequence and features. The game also increases the potential with the Random Wilds feature to add Starburst Wilds to a vacant reel at the end of a spin. Every Starburst Wild gives a random multiplier with potential wins of x2, x3, x5, x10, x25, x50, x100, or even x150.

The new feature is sure to be a big hit with the gaming market as online gambling has shown significant growth during the lockdown. AdAge indicates the current casino customer base is an estimated one in five Americans, so Starburst XXXtreme’s additional features will achieve considerable popularity.

What We Think About The Game

The gambling market has continued to diversify post-pandemic, so it is one of the most opportune times to release an online casino-based game. Thankfully Starburst XXXtreme features eye-catching visuals, including the jewels and space themes. These attract audience participation and make the gameplay inviting. The game also has a nostalgic edge. The previous NetEnt iteration featured similar visuals and gameplay, so the audience has some familiarity with it. The producers have revamped this version by tweaking the features to improve the volatility and engagement.

That is characterized by the potential win cap of 200,000 times the bet. Starburst XXXtreme does not just give betting alternatives for players that want to go big. The increase of multipliers also provides a great experience. If the respins in the previous version were great, knowing that multipliers can go hundreds of times overtakes the game to a new level.

Players should get excited about this offering. All of the features can be triggered within a single spin. Whether one plays the standard game or takes the XXXtreme spin route, it is possible to activate all of the features. Of course, the potential 200,000 times potential is a huge carrot. However, the bet size is probably going to be restricted and vary depending on the casino. It is also worth pointing out that a malfunction during the gameplay will void all of the payouts and progress. Overall, the game itself has been designed to provide a capped win of 200,000 times the original bet.

Anglais

‘We’re back’: Montreal festival promoters happy to return but looking to next year

Published

3 années agoon

juillet 23, 2021By

admin

In downtown Montreal, it’s festival season.

In the city’s entertainment district, a musical act was conducting a sound check on stage Friday evening — the second day of the French-language version of the renowned Just For Laughs comedy festival. Tickets for many of the festival’s free outdoor shows — limited by COVID-19 regulations — were sold out.

Two blocks away, more than 100 people were watching an acoustic performance by the Isaac Neto Trio — part of the last weekend of the Festival International Nuits d’Afrique, a celebration of music from the African continent and the African diaspora.

With COVID-19 restrictions continuing to limit capacity, festival organizers say they’re glad to be back but looking forward to next year when they hope border restrictions and capacity limits won’t affect their plans.

Charles Décarie, Just For Laughs’ CEO and president, said this is a “transition year.”

“Even though we have major constraints from the public health group in Montreal, we’ve managed to design a festival that can navigate through those constraints,” Décarie said.

The French-language Juste pour rire festival began on July 15 and is followed by the English-language festival until July 31.

When planning began in February and March, Décarie said, organizers came up with a variety of scenarios for different crowd sizes, ranging from no spectators to 50 per cent of usual capacity.

“You’ve got to build scenarios,” he said. “You do have to plan a little bit more than usual because you have to have alternatives.”

Anglais

MELS new major movie studio to be built in Montreal

Published

3 années agoon

juillet 23, 2021By

admin

MONTREAL — MELS Studios will build a new film studio in Montreal, filling some of the gap in supply to meet the demand of Hollywood productions.

MELS president Martin Carrier said on Friday that MELS 4 studio construction will begin « as soon as possible », either in the fall or winter of next year. The studio could host productions as early as spring 2023.

The total investment for the project is $76 million, with the Quebec government contributing a $25 million loan. The project will create 110 jobs, according to the company.

The TVA Group subsidiary’s project will enable it to stand out « even more » internationally, according to Quebecor president and CEO Pierre Karl Péladeau. In the past, MELS Studios has hosted several major productions, including chapters of the X-Men franchise. The next Transformers movie is shooting this summer in Montreal.

Péladeau insisted that local cultural productions would also benefit from the new facility, adding that the studio ensures foreign revenues and to showcase talent and maintain an industry of Quebec producers.

STUDIO SHORTAGE

The film industry is cramped in Montreal.

According to a report published last May by the Bureau du cinéma et de la télévision du Québec (BCTQ), there is a shortage of nearly 400,000 square feet of studio space.

With the addition of MELS 4, which will be 160,000 square feet, the company is filling part of the gap.

Carrier admitted that he has had to turn down contracts because of the lack of space, representing missed opportunities of « tens of millions of dollars, not only for MELS, but also for the Quebec economy. »

« Montreal’s expertise is in high demand, » said Montreal Mayor Valérie Plante, who was present at the announcement.

She said she received great testimonials from « Netflix, Disney, HBO and company » during an economic mission to Los Angeles in 2019.

« What stands out is that they love Montreal because of its expertise, knowledge and beauty. We need more space, like MELS 4, » she said.

There is still not enough capacity in Quebec, acknowledged Minister of Finance, the Economy and Innovation Eric Girard.

« It is certain that the government is concerned about fairness and balance, so if other requests come in, we will study them with the same seriousness as we have studied this one, » he said.

Grandé Studios is the second-largest player in the industry. Last May, the company said it had expansion plans that should begin in 2022. Investissement Québec and Bell are minority shareholders in the company.

For its part, MELS will have 400,000 square feet of production space once MELS 4 is completed. The company employs 450 people in Quebec and offers a range of services including studio and equipment rentals, image and sound postproduction, visual effects and a virtual production platform.

MAPEI Canada inaugure l’agrandissement de son usine à Laval, au Québec

Le Gala Elles reconnaissent célèbre les femmes remarquables de l’industrie de la construction

Préparez votre maison pour l’hiver afin d’éviter les réclamations d’assurance

Quatre façons de commencer à travailler dans le domaine des ventes

La Commission indépendante soutient le recours de la Cour suprême contre le déni des droits des non-francophones par le Québec

Justin Trudeau est un raciste contre les Noirs et les Premières Nations – 14 signes

Enfants aux études loin de la maison : Trois conseils pour veiller à la santé de leurs finances

Règles et règlements que toutes les entreprises canadiennes doivent connaître

Épargnez pour l’avenir grâce à nos trucs financiers pour la rentrée

Efficacité énergétique: 10 façons économiques de l’améliorer

Ces légendes du baccara vous dévoilent leurs secrets

Retard de vol : le devoir de la compagnie envers ses passagers

Nostalgia and much more with Starburst XXXtreme

Même les jeunes RÉPUBLIQUES se lassent du capitalisme, selon les sondeurs américains — RT USA News

« Aucune crise climatique ne causera la fin du capitalisme ! »

Innovation : le capitalisme « responsable », faux problème et vraie diversion

Vers la fin du Capitalocène ?

Le “capitalisme viral” peut-il sauver la planète ?

Livre : comment le capitalisme a colonisé les esprits

Patrick Artus : « Le capitalisme d’aujourd’hui est économiquement inefficace »

Body found after downtown Lethbridge apartment building fire, police investigating – Lethbridge

Comment aider un bébé à développer son goût

Head of Toronto Community Housing placed on paid leave

Salon du chocolat 2018: les 5 temps forts

This B.C. woman’s recipe is one of the most popular of all time — and the story behind it is bananas

Gluten-Free Muffins

We Try Kin Euphorics and How to REALLY Get the Glow | Healthyish

Man facing eviction from family home on Toronto Islands gets reprieve — for now

Condo developer Thomas Liu — who collected millions but hasn’t built anything — loses court fight with Town of Ajax

27 CP Rail cars derail near Lake Louise, Alta.

Ontario’s Tories hope Ryan Gosling video will keep supporters from breaking up with the party

Renaud Capuçon, rédacteur en chef du Figaroscope

Paris : chez Cécile Roederer co-fondatrice de Smallable

Ontario Tories argue Trudeau’s carbon plan is ‘unconstitutional’

100 years later, Montreal’s Black Watch regiment returns to Wallers, France

Trudeau government would reject Jason Kenney, taxpayers group in carbon tax court fight

Ford Ranger Raptor, le pick-up roule des mécaniques

Los Angeles poursuit The Weather Channel pour atteinte à la vie privée

Le Forex devient de plus en plus accessible aux débutants

The Bill Gates globalist vaccine depopulation agenda… as revealed by Robert F. Kennedy, Jr.

Trending

-

Anglais5 années ago

Anglais5 années agoBody found after downtown Lethbridge apartment building fire, police investigating – Lethbridge

-

Santé Et Nutrition4 années ago

Santé Et Nutrition4 années agoComment aider un bébé à développer son goût

-

Anglais5 années ago

Anglais5 années agoHead of Toronto Community Housing placed on paid leave

-

Styles De Vie5 années ago

Styles De Vie5 années agoSalon du chocolat 2018: les 5 temps forts

-

Anglais5 années ago

Anglais5 années agoThis B.C. woman’s recipe is one of the most popular of all time — and the story behind it is bananas

-

Santé Et Nutrition6 années ago

Santé Et Nutrition6 années agoGluten-Free Muffins

-

Santé Et Nutrition5 années ago

Santé Et Nutrition5 années agoWe Try Kin Euphorics and How to REALLY Get the Glow | Healthyish

-

Anglais5 années ago

Anglais5 années agoMan facing eviction from family home on Toronto Islands gets reprieve — for now